By Thomas Schneck • March 02, 2017

If integrating procurement and accounts payable can shave up to 12% for external spend, why do CFOs throw up their hands when thinking about automating the procure to pay process and say, “It’s too difficult. The technology is unproven. It will disrupt my staff and we’ll never get any real work done.”

The reason for this reluctance is that the typical procure to pay cycle has a LOT of moving parts. To make things even more challenging, each of these moving parts is often “owned” by a different stakeholder. P2P initiatives typically bring together departments responsible for purchasing, delivery, receiving, inventory management, distribution, invoicing, and payment. Standardizing on a platform to satisfy each of these key stakeholders can sometimes seem overwhelming.

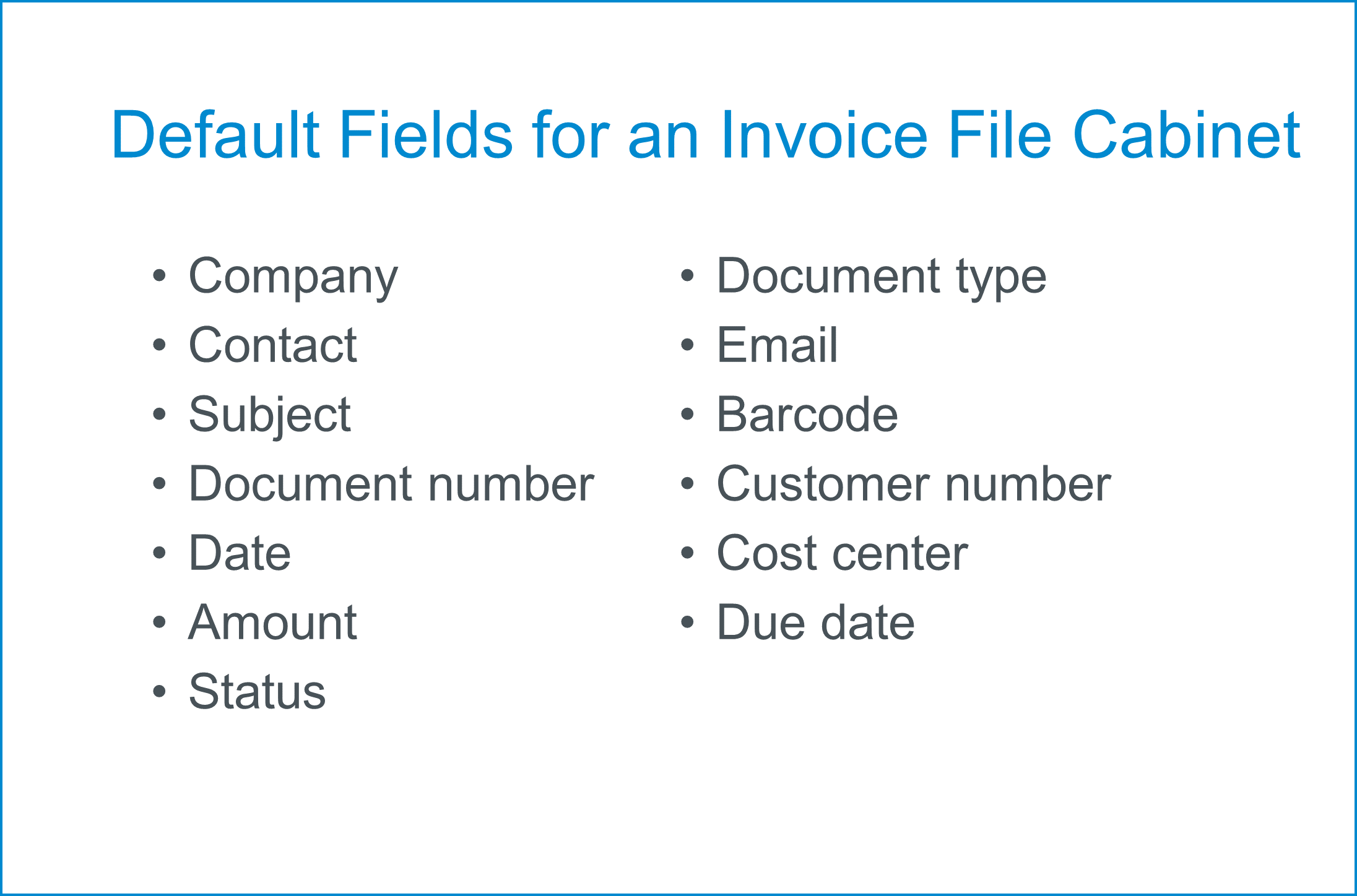

That’s the bad news. The good news is that the technology part of redefining this process is usually the most straightforward part. In particular, the document management functionality needed to effectively support the procure to pay cycle is proven and widely deployed.In fact, your office could go paperless in just 90 days. Find out how by downloading our free whitepaper.Before you hop into a process to pay process automation initiative, what do you need to know?

- The payoff of automating the procure to pay cycle can be huge. 40 percent of a company’s costs are composed of external spending – and by better integrating procurement and accounts payable companies can cut the cost of their annual external spend by between eight to 12 percent. [source: https://www.theaccountspayablenetwork.com]

- Effective management of the procure to pay cycle is critical to achieving bigger goals. Vishal Patel notes that poor supplier data is responsible for nearly 70% of payment delays. Leading edge organizations have elevated the importance of Supplier Relationship Management (SRM) to a level equal to that held by Customer Relationship Management (CRM) and the procure to pay process is critical to SRM.

- Automating the procure to pay cycle is more about silos than technology. “Most organizations run P2P in two separate silos: Procurement is responsible for selecting and negotiating terms with vendors and then ordering goods or services from those vendors. And then the purchase gets tossed over the wall to AP to pay for it.” [source: Jess Scheer, Continuing Education Manager, at the Institute of Finance and Management]

Automating the procure to pay process is a significant change management initiative for most organizations and requires commitment. But the potential payoffs are huge, and the core document management technologies required to support P2P automation are proven and stable. Organizations can start by automating pieces of the P2P process and build competencies over time. A great place to start is with a scalable document infrastructure that easily integrates into your core procurement and financial systems. Are you ready to see how DocuWare can help you automate the procure to pay process? Sign up for a free demo today.

Topics: Workflow, Accounts Payable, Integration, Transitioning